How to Register for GST?

Registering for GST is a legal requirement in Australia if your business expects to make annual sales of AUD 75,000 or more. Before beginning the registration process, you must obtain an Australian Business Number (ABN). Once you have an ABN, follow these simple step-by-step instructions for GST registration through the ATO Business Portal.

Registering for GST via ATO Busniess Portal

The ATO portal is an online platform that enables you to view or update information related to your business with the taxation office. Through this portal, you can register for GST, request a refund, transfer funds between ATO accounts, download files, and more.

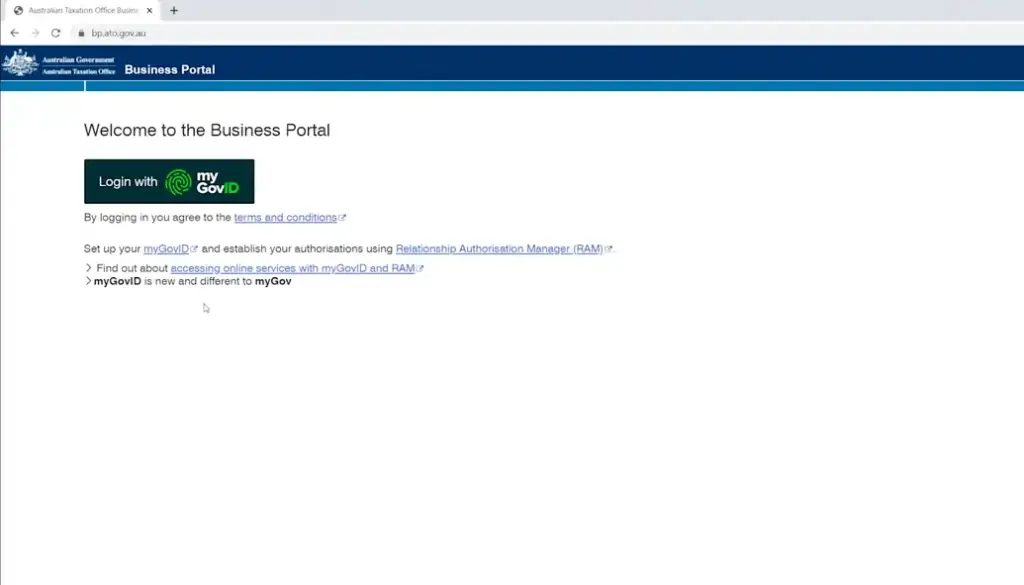

Step 1: Log in to the ATO Portal

Login to the portal using this link https://bp.ato.gov.au

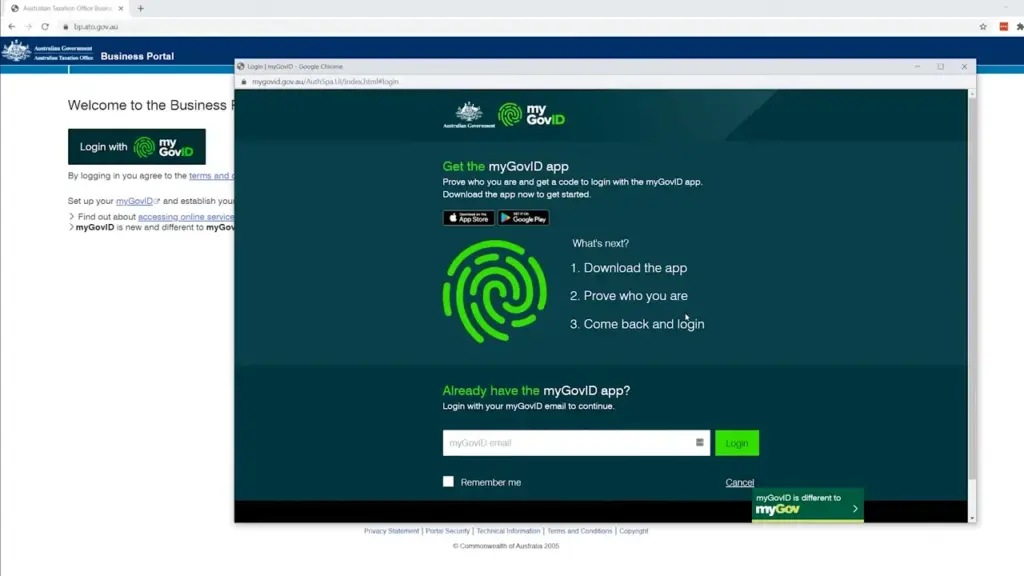

After landing on the login page, click on ‘myGovID.’ This will take you to the following page where you should follow these instructions:

Once you have completed the process, enter your email in the designated box and click on the ‘Login’ button. A four-digit code will appear. Open the myGovID app on your mobile phone, enter the four-digit code, and accept. You will then be automatically logged in to the business portal.

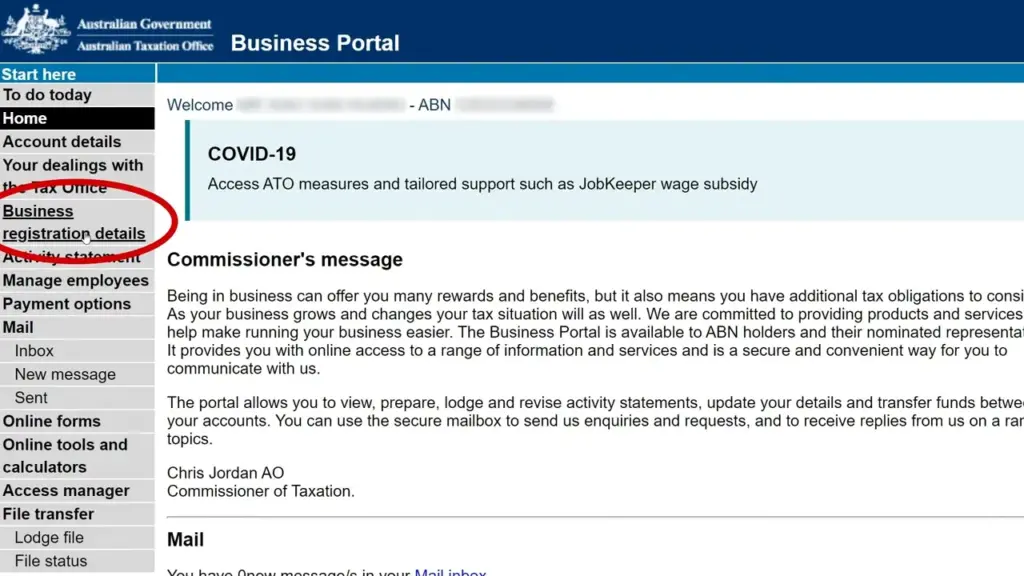

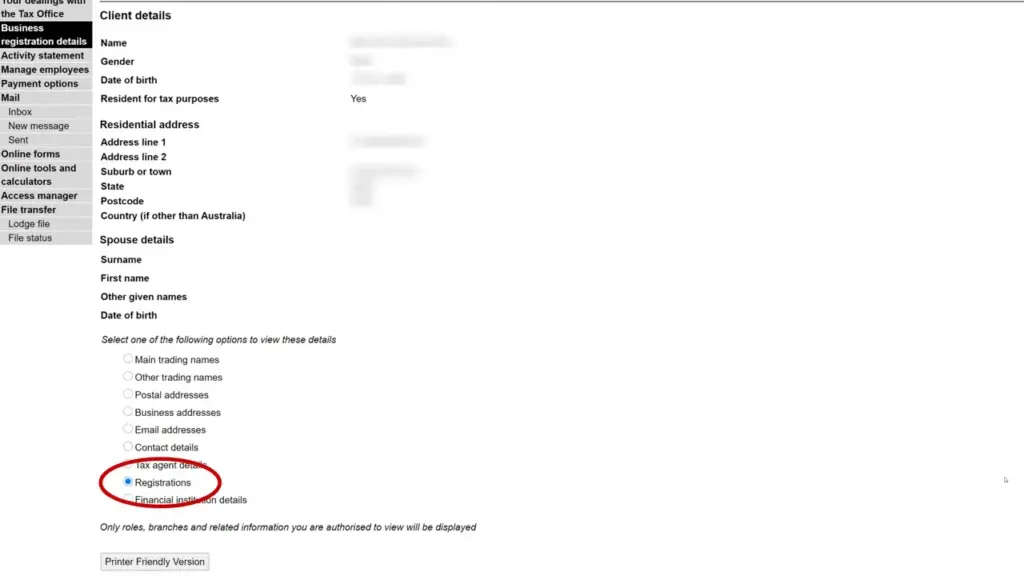

Step 2: Click on the Business Registration Details Menu

Now, on the left side of the dashboard in the business portal, navigate to the business registration details menu and click on it.

This will open a menu. Go to the bottom and look for ‘registration’. Select it and click on ‘Next’.

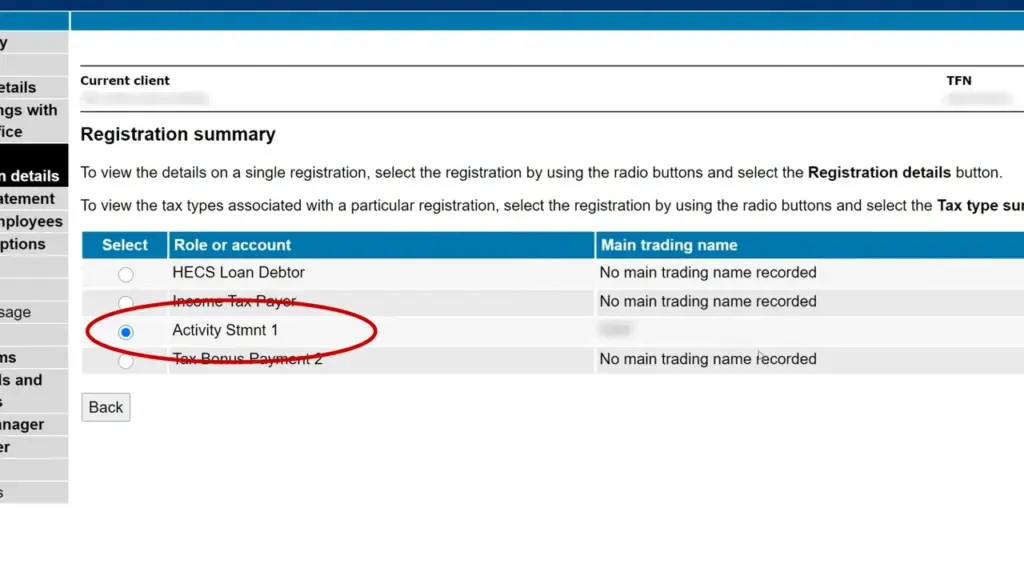

Step 3: Click on ‘Activity Stmnt 1’ and ADD Tax type

There will be an option called ‘Activity Statement 1’. This is where you can register for GST. Select it and click on ‘Add Tax Summary’.

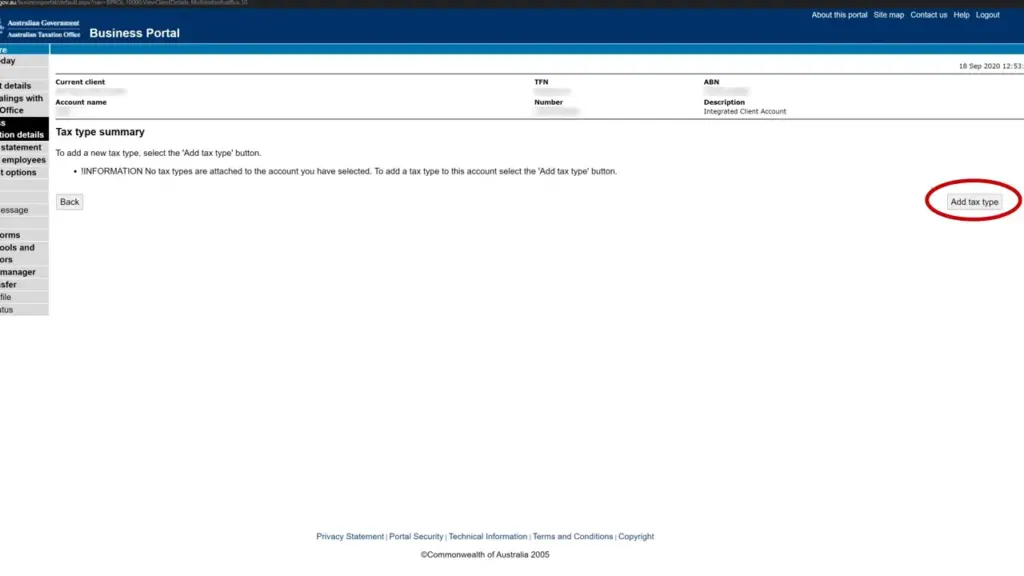

A blank screen will appear because you are not GST registered. To register for GST, click on the ‘ADD Tax Type’ button.

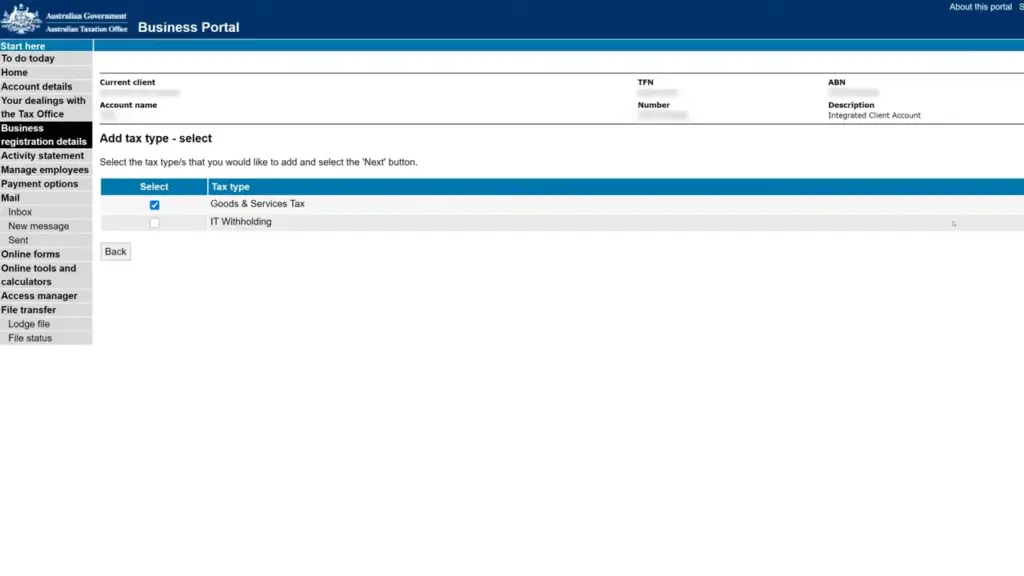

Step 4: Select ‘Good and Services Tax’ and click next

A window containing the GST and IT withholding options will appear. Click on either of the two according to your requirement. In our case, we will select Goods and Services Tax and click the next button.

Step 5: Submit

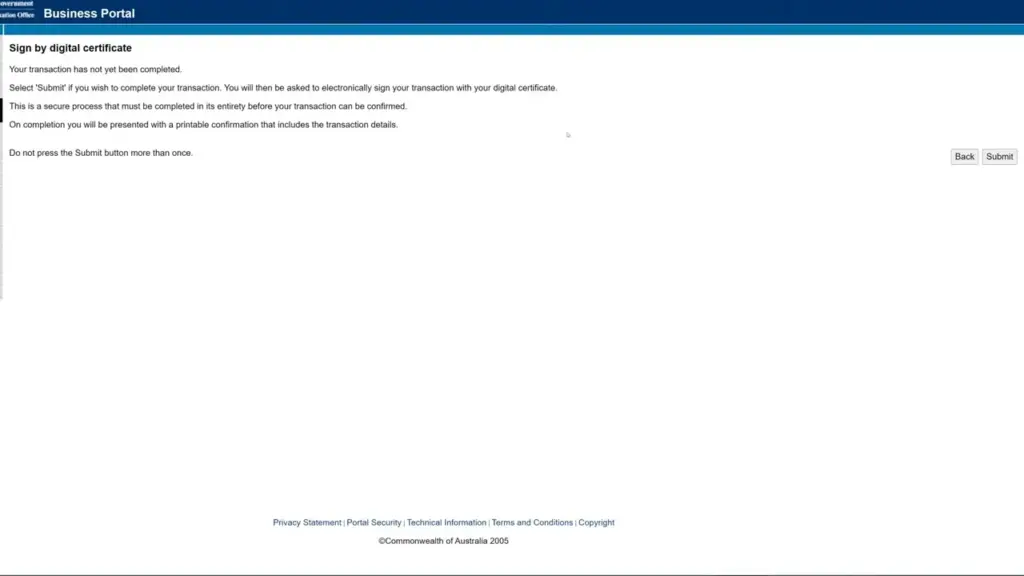

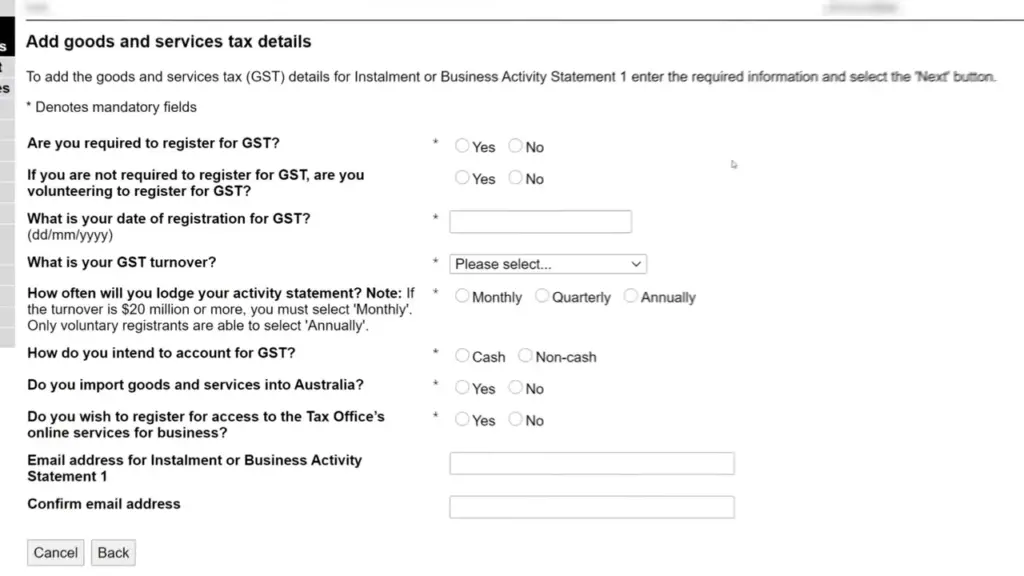

They will ask you a series of questions. Carefully select them according to your criteria, review them, and click ‘Next’.

It will take you to the sign page to confirm those details. Hit the submit button, and that’s it, your registration is now complete. Wait for 24 hours and search on ABN Lookup to see your registration