GST CALCULATOR

Stop Guessing, Start Calculating Now!

Stop worrying about calculation errors! Whether you’re a business owner or a consumer, our Australian GST calculator will help you make informed decisions and avoid any hidden costs included in the price. Get instant and accurate results with just a few clicks to add or subtract GST from a given amount.

🇦🇺 Australian GST Calculator

Professional tax calculation tool for businesses and individuals

The goods and services tax (GST) is a federal value-added tax of 10% on most services, sales, goods, and other items imported or consumed in Australia. The GST was first introduced on 1 July 2000 by the Howard Government, replacing the previous tax system. Whether you live in Brisbane, Victoria, New South Wales(NSW), or Sydney, GST applies to the overall country.

How to Calculate GST?

Calculating the GST using our calculator is super easy! You just have to put your price in the ‘Enter Amount’ box and GST value, which is 10% in Australia, in the 2nd box. Now, there are two buttons: a Green one for adding GST and a Red one for subtracting GST. After entering your desired inputs, the results are displayed, and there is also a button to copy the result. We’ve made this calculator error-free and advanced, acting as an inclusive and exclusive calculator. You can input any value for the GST, not limited to only 10% and find GST for other countries like New Zealand and Singapore. Simply enter your desired tax value and total price, then click one of the two buttons according to your requirements.

Benefits

GST Calculation Formula

There are two scenarios for GST calculation in Australia: the first involves adding GST to the net price, while the second involves subtracting GST from the net price. Let’s examine each scenario in detail, one by one, with examples.

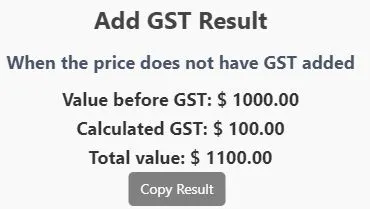

Adding GST to Price

This method is used when adding GST to a sale amount where the price does not include GST.

You can also use the following general formulas:

- GST Amount = Original Price ✕ GST rate/100

- GST Incl value = original price ✕ (1+ GST rate/100)

You can find these values within seconds using our calculator without any calculation error.

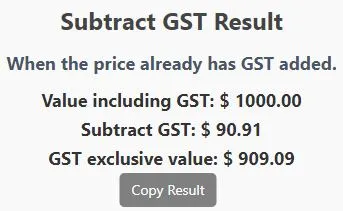

Subtracting GST from Price

This method is used when the original price has GST added, and we have to find how much GST is added or the price exclusive of GST. For reverse GST calculation:

The general formulas for this are:

- GST Amount = Original Price ✕ GST rate∕(100+GST rate)

- GST excl value = original price ✕ 100/(100+ GST rate)

Our advanced calculator can find these values with a button click.

GST Free items in Australia

In Australia, some products and services are GST-free:

Products

Services

Calculating GST on imported Goods for business and individual

To calculate GST on the imported goods depends upon the value and its use. What makes up the value of good? Well! When you’re importing anything into Australia certain things contribute to the total value of the goods: The cost of the goods themselves, the custom tax levied by the Australian government, delivery costs, and transport insurance.

For Individuals

There is no GST on the import of low-value goods for individual shoppers. The goods for which the combined customs duty and taxes are AUD 50 or less and the actual value of the goods themselves is under AUD 1,000. So, if you’re buying a cute phone case for AUD 20 with AUD 5 shipping (and no customs duty), you won’t pay any GST on it!

For Business

If you’re running a business in Australia and importing goods for resale purposes through your business, then your purchases will likely exceed AUD 1,000, and you are likely to pay GST on them. Here’s the good news: you can claim GST credits on those imports! Think of GST credits as a partial refund for the GST you pay when importing goods.

For example, if you’re importing clothes for your GST-registered store located in NSW for AUD 30,000, you’ll likely pay GST on this amount when it arrives in Australia. Let’s do some calculations: Clothes cost = AUD 30,000, Custom tax = AUD 1,500, Delivery and insurance cost = AUD 2,000. The total value of the clothes becomes AUD 33,500.

When to Register for GST in Australia?

In Australia, businesses, non-profit organizations, and self-employed individuals must register for Good and Services Tax if:

Once you become eligible for GST registration, you have a 21-day deadline to complete the process. Failure to register on time can result in penalties and interest. A single GST registration covers all your businesses if you operate multiple businesses.

GST Turnover Threshold

| Business Type | GST Turnover |

| Self-employed/sole trader | AUD 75,000+ |

| Busniess | AUD 75,000+ |

| not-for-profit Organisation | AUD 150,000+ |

| taxi or a ride-sourcing driver | Always register |

Importantly, you will need an Australian Business Number (ABN) to register. Once you have an ABN, you can register online through the Online Services for Business portal, by phone at 13 28 66, or through a registered tax agent or BAS agent. Use our calculator to determine the amount of GST turnover to be paid.

Now the question is how to register for GST in Australia. Visit the page GST Registration, here is a complete step-by-step process with images to register your business via the ATO business portal.

Frequently Asked Questions (FAQs)

James Johnson

Stanley Bruen is a highly skilled professional chartered accountant and financial expert. He has a deep understanding of the Australian tax system and has become a trusted advisor for a wide range of clients, from small businesses to multinational corporations. His expertise makes him a pro at navigating the complexities of Australian taxes and VAT calculation, ensuring your finances are always in top shape.